Books Reviewed

An astonishing new epoch of wealth creation has begun. In 2017 eight Google researchers released a scholarly paper igniting the current boom in artificial intelligence (A.I.). As the paper explained, these researchers “dumped out all the existing neural architectures” used at Google and announced a “transformer” model, which calculated responses almost instantly in parallel on vast databases. As a result, as former Google A.I. prodigy Andrew Ng of Stanford observed, the time to launch a new A.I. application dropped from years or months to days or even hours.

With systems that process more text or images in seconds than a human could consume in a lifetime, awed researchers imagined that the system was spontaneously beginning to think like a human—or at least a computer scientist—even showing glints of consciousness. Deeming the group to have mastered the mystery of mind, Google CEO Sundar Pichai called the discovery “more important than electricity or fire.”

The paper’s initial effect was clear. It enhanced Google’s reputation and brought its search engine even closer to being a monopoly, while enriching its billionaire founders and other investors. In seven years, Google’s market cap rose from $729 billion to $1.95 trillion. Founders Larry Page and Sergey Brin both became centibillionaires. All the paper’s authors themselves became wealthy. In the conventional capitalist model, it seemed like a home run of technological research and innovation rewarded by the market.

***

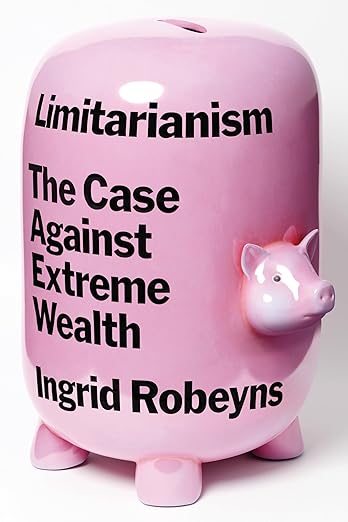

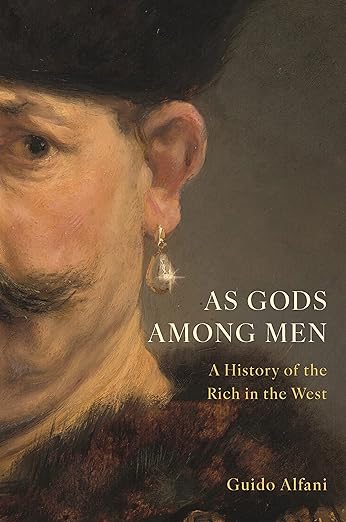

The issue raised by two new books from Europe is whether such enrichment and corporate enhancement is good or bad for the world. Limitarianism: The Case Against Extreme Wealth, a fiery polemic by Dutch feminist philosopher Ingrid Robeyns, and As Gods Among Men: A History of the Rich in the West, a comprehensive academic study of inequality by Italian economic historian Guido Alfani, want us to look beyond the immediate effects of wealth creation and pay attention to a larger, more sinister context. The authors maintain that events such as the A.I. boom make the rich richer and the poor poorer, an instance of capitalism’s inevitable degeneration into plutocracy. Robeyns also imagines that such wealth events are causing climate change and menacing the planet. Both books convey the impression that our wealth is a mirage, effectively nullified by the hidden costs of environmental damage and class exploitation.

Leftist writing about wealth creation is like flat-earth theorizing about physics. Lacking any grounded understanding of the subject, the two books deploy the usual pejoratives about “monopoly capitalism” without even attempting to explain how wealth actually arises in the modern world. Critiques of contemporary capitalism that fail to come to terms with its actual achievements spin their wheels, going nowhere.

Repeatedly quoting French economist Thomas Piketty’s Capital in the Twenty-First Century (2013), the two authors downplay new technology and focus on “slavery and colonialism” as playing “a central role in the Western World’s acquisition of wealth.” Since the late 1970s, says Piketty, we have been on the road to “a new quasi-feudal era in which the few would have almost everything, while the many would have almost nothing at all.”

***

Apparently feeding this insidious spiral of exploitation and plutocracy, how did these Google “transformer” authors do it? This “transformer” approach from Google turned the world of artificial intelligence upside down. The efflorescence of A.I. companies that followed promises to extend human lives, enhance energy efficiencies, and foster creativity that can revitalize the entire world economy.

The two “limitarian” authors would point out that this sunny tale of wealth creation leaves out crucial side effects. The size of data centers can be measured either by the exabytes of the databases they can manage or by their terawatt consumption of energy. Now using more than 1% of global energy, with consumption rising 60% per year, datacenters are projected to engorge as much as 8% of global terawatts by the next decade on a trajectory toward becoming the leading energy user and pollution emitter on the planet.

We need some limits, according to Robeyns and Alfani. Hence, the movement to halt expansion of this predatory and exploitative system presumably dominated by giant monopolies such as Google and riven by growing inequality that threatens the social order.

But does this breakthrough at Google mean that Google and its promethean “Google Brain” and “Deep Mind” divisions actually exerted near-monopoly control over the A.I. market as Robeyns and Alfani fear? Did Google take over A.I. in a way resembling their dominance over search engines? Not at all.

The eight researchers have all left Google. Becoming entrepreneurial spearheads in new A.I. companies, they are now competing with their former employer. All eight “transformer” authors, six from outside the U.S., were born to impoverished or middle-class families but now command equity in their companies summing up to scores of millions of dollars apiece. Spawning companies that plausibly promise to “transform” such technological domains as medicine and prosthetics, translation and robotics, energy and materials science, the breakthrough could end up generating trillions of dollars of new wealth. On paper, all the authors are now rich beyond their dreams and beyond limitarians’ worst fears.

***

Both Limitarianism and As Gods Among Men aim to curtail such emergent wealth. Robeyns seeks a global movement against “neo-liberalism” that caps all fortunes at €10 million. Wealth beyond that limit, she declares, is “immoral” and should be relinquished to government. “Via politics and institutional design, governments should try to make sure that no one accumulates more money than this,” she writes. “[I]t should be as hard a limit as possible.”

Although not explicitly endorsing a particular cap on wealth, Alfani claims to have identified close parallels between medieval feudal titans such as Cosimo Medici, wealthy beneficiaries of putative “fascism” such as the late Italian Premier Silvio Berlusconi, and modern tycoons such as Bill Gates, Elon Musk, and Jeff Bezos. He analogizes Medici’s bailout of the financial system of Florence during a crisis in the early 15th century to American banker J.P. Morgan’s saving the American financial system in the crash of 1907. In his view, nothing essential has changed. Alfani focuses on relative wealth: fortunes larger than ten times the median wealth in a society. Such fortunes, he believes, corrupt economic and political systems, spreading poverty in their wake.

The two books uphold a view of enterprise as a consequence of “greed” or “exploitation.” As Robeyns sums up, anti-limitarians believe “the mantras that ‘greed is good’ and ‘the sky is the limit.’” Both authors are concerned with inadequate rewards for idealistic academic professionals compared to greedy entrepreneurs. Successful inventors and entrepreneurs, Robeyns allows, should be rewarded like professors with “honorary doctorates” and other tributes. (Perhaps they could also be granted tenure and sabbaticals?) Meanwhile, she contends, “If [COVID era] governments had effectively taxed the [super-rich], they could have used the revenue to provide everyone with protective masks and home test kits.” Similarly, “[t]he $28 million it cost [Jeff Bezos] to fly into space for twelve minutes could have saved an estimated 6,200 lives.”

At the heart of both books’ argument is replacement of previous maps of wealth distribution that focus on annual incomes, wages, and salaries. According to the authors, such measures drastically underestimate inequality. The annual incomes need context. Defined as all equity holdings including stocks and private assets, inequality emerges as virtually infinite, since most people in their early years have no net assets at all. For example, most homeowners and nearly all young homeowners have mortgages that exceed in liability the residual value of their homeownership.

Such factors fuel Piketty’s cartoon of egregious inequality under capitalism, with most people owning no net assets at all and widespread homelessness, while Bernard Arnault, the French fashion magnate in command of Dior, Vuitton, and Sephora, gains a net worth of some $233 billion. As the richest man in the world for two years in a row, according to Forbes, he joins an array of U.S. information technology billionaires such as Bezos, Brin, and Page in the top ten and is cementing a “succession plan…to keep family control” by “adding his sons Alexandre and Frederic to [his] board, where they would join his two eldest children, Antoine and Delphine.”

***

Both Robeyns and Alfani conflate wealth with money. Believing that wealth is tantamount to money, they evoke images of Google founders Brin and Page and other titans frolicking in vast oceans of cash. To the authors, there is no difference between money income and wealth appreciation except that these capital gains escape taxation. Holding equities is deemed an insidious way of evading taxes on real gains.

Nonetheless, this conflation is spurious. Money is liquid cash and central bank reserves that can be immediately expended to buy things. Wealth, by contrast, is illiquid. It is invested. That means it is in use, embodied in projects and ventures contingent on future plans and expectations.

In enterprise, you can only keep what you give away. If you demand the cash back, you often jeopardize the success of your venture. Investments are defined by the possibility of failure. Those seven ex-Google A.I. Croesuses all run A.I. companies with no net profits. They could all go bankrupt at any time. As tenured professors, Robeyns and Alfani have scarcely a clue about the protean contingency of most entrepreneurial wealth.

For example, if the entrepreneur founders began selling the shares of their start-up companies in order to pay a “wealth tax”—as the authors of the transformer paper demand—the value of the shares would likely drop faster than they could sell. Even if the shares were nominally liquid, they are in practice unsalable by the owner-entrepreneur, since the result would be to make him less an owner-entrepreneur and thus deplete the key source of market value for the company.

As I detailed in Life After Capitalism (2023), wealth, unlike money, is essentially knowledge commanded by the owners. Wealth is not material resources as Robeyns and Alfani suppose, but a fabric of ideas and commitments, expectations and insights, experiments and projections, that together constitute the worth of the venture.

***

As economist Thomas Sowell wrote back in 1971, “the Neanderthal in his cave had all the natural resources we have.” The difference between our age and the Stone Age is entirely the growth of knowledge. The growth of knowledge is learning, which conveys the essence of economic growth. As manifested in “learning curves,” ubiquitous in enterprise, costs of production predictably drop by 20-30% with every doubling of sales.

Alfani concedes that “arguably society profits from the rise of entrepreneurial innovators,” but insists that “this process is not without victims.” Thus, “this picture of abundant opportunities for many should not be understood as one of improvement for all.” Alfani’s truism—opportunities for many are not improvements for all—is in fact deeply misleading as it implies a static “all.” Since world population under capitalism rose from a few hundred million in the 18th century to 4.4 billion in 1980 to 8 billion today, the improvement was indeed vastly greater for “all.” The per capita gains of wealth actually benefited some tenfold more people than the population at the outset. The chief benefit of wealth is many more people living many more years.

The comparison of different epochs—pre-capitalist and capitalist—leads to many misconceptions. Piketty’s stress on slavery and colonialism as sources of Western wealth fails to recognize that Western colonialism spread capitalism and ultimately ended slavery. Until the rise of entrepreneurial capitalism with the industrial revolution, slavery, de jure or de facto, was so to speak the natural condition of nearly all mankind. The vast majority of human beings had to work all their waking hours merely to feed and house themselves.

The change is best measured by time-prices, as conceived by Yale Nobel Laureate William Nordhaus, to capture the buying power of work-hours across time and space. In a famous 1993 essay, “Do Real Income and Real Wage Measures Capture Reality? The History of Lighting Suggests Not,” Nordhaus showed that by concentrating on monetary prices, rather than on “real labor costs” measured in time, economic historians hugely underestimated the improvement of living standards forged by the industrial revolution.

Measured by labor hours to buy lighting, Nordhaus showed that while poets wrote about “dark satanic mills,” human innovation was illuminating the night, effectively expanding the hours of the day. Epitomized by the move from whale oil to kerosene, by 1900 the cost of light plummeted to merely one-tenth of 1% of its level in 1800. Today, the cost of lighting, measured in the work-time needed to purchase lumens, has dropped another 99%.

As applied to recent economic history by Marian Tupy and Gale Pooley in Superabundance (2022), the time an average worker has to spend to earn the money to acquire 50 crucial goods and services that sustain his life has declined since 1980 by 75% and since 1850 by over 90%. Just to feed themselves, people had to devote roughly eight hours every day. Today most of the world population feeds itself in a matter of minutes, leaving scores of hours for other activities.

***

Although Robeyns and Alfani misfire on many fronts, their arguments do reflect an important intuition that something has gone awry. In contrast to Cosimo Medici and J.P. Morgan personally stopping a run on their nations’ banks, the U.S. government bailed out J.P. Morgan bank and all its counterparts as “too big to fail” after the financial panic of 2008. Something has indeed changed.

Over recent decades, climaxed during the COVID and mRNA vaccine crises, governments have adopted a regime that could be termed “emergency socialism.” Around the world, in the name of various “crises,” politicians have reduced their banking systems to government dependencies, run by central banks printing money in order to pay off political cronies and constituents by stealing from the future.

These same governments have debilitated their energy systems with fake emergency “climate change” socialism. This new religion, upheld by Robeyns and bureaucrats around the world, mandates costly worship of windmill totem poles and druidical sun henges that yield no net new power after calculating for subsidies, mandates, battery backup, wastage of scarce arable land, and more complex and vulnerable power grids. To avoid exposure, these governments have subordinated the media, including credulous academics like our authors, to public “information” and misinformation policies.

This “hypertrophy of finance” that I describe in Life After Capitalism is fostering more inequality based not on merit but on government privileges. The world’s central banks have become a fourth branch of government, manipulating economic activity and rendering the system fragile and arbitrary. This is a serious threat to the future of capitalism, which makes it a threat to prosperity and civilizational flourishing.

***

One egregious symbol of financial hypertrophy is futile and mostly meaningless currency trading. Trading of currencies for one another, second by second, is now some 73 times larger than all world trade in goods and services put together. In pure volume, that makes currency trading the world’s largest industry. Yet with floating currency prices far less reliable than the gold standard that preceded it, all this shuffling fails to establish values more stable than the economic activity currency supposedly measures. This perversion of money under “emergency socialism” is the leading cause of immutable inequalities based on power and privilege rather than on knowledge and on contributions to the economy.

New forms of money based on the cryptographic blockchains and gold may well evolve in coming decades and emancipate the world economy from its central bank socializers. Until this entrepreneurial movement transforms finance, the arguments of Limitarianism and As Gods Among Men will seem plausible to much of the public. But the popular hostility toward income inequalities is a symptom of an even more general misunderstanding of the nature of material progress promoted by conservatives and socialists alike.

Ingrid Robeyns and Guido Alfani repeatedly stress “greed” and consumption as driving forces of capitalist inequality. But contrary to the prevailing theory inherited from Adam Smith’s “invisible hand,” a capitalist economy is not chiefly an incentive system based on stimulus and response. Entrepreneurs are creators, not mere production functions governed by incentives that restore equilibrium to markets.

***

Creativity is disequilibrium. It is surprise, not order. No one expected that transformer paper. No one anticipated thousands of new companies pioneering new 2-D materials such as graphene that can be made from plastic waste and other garbage. Physics tells us that matter is conserved. What separates our age from the Stone Age is the growth of knowledge through human creativity. As MIT’s César Hidalgo explained in Why Information Grows (2015), when an expensive car collides with a wall, all its value is lost, though all its material atoms and molecules are preserved. Value is information. The car is knowledge.

Knowledge is linked to particular minds and is not freely convertible into money, which is provided by governments and mostly controlled by them. To transform all the world’s wealth into money would be tantamount to destroying it—liquidating it. Its value comes from not being spent but being integrated with creative enterprise and learning.

As illustrated by Limitarianism and As Gods Among Men, we are entering a dangerous era in which intellectuals effectively deny the existence of the human mind and creativity. We are moving from sexual suicide, denying differences between the sexes, to intellectual suicide, denying the differences between creative human minds and predatory pirates and slaveholders. The key error of these two books is their near total neglect of global demographic change. The two authors blur the differences between centuries of stagnation under feudal systems and an entrepreneurial arena of world capitalism in which global population roughly doubled in 50 years while longevity increased some 40%.

In this dynamic international arena, inequality actually plummeted. For example, China’s GDP was just 7% of U.S. GDP in 1980 at the dawn of Deng Xiaoping’s liberalization campaign. By 2017, Chinese GDP became 61% of U.S. GDP. Now it is roughly equal in per capita terms and even larger in terms of time prices. As demonstrated in a more interesting book from Europe, The Power of Capitalism (2018) by Rainer Zitelmann, such formerly Communist countries as Vietnam and Poland have become among the fastest growing capitalist economies in the world and the most entrepreneurial.

The limitarians really want to reduce world population and, by banning inheritance, dissolve the fabric of family outside government control. Their limits to growth would actually mean worldwide limits to life. But their assumption that innovation is not sustainable echoes Karl Marx in the 19th century and is no more plausible or moral today than it was then.

If we limit government rather than wealth, however, the sky is indeed the limit for humanity.