Books Reviewed

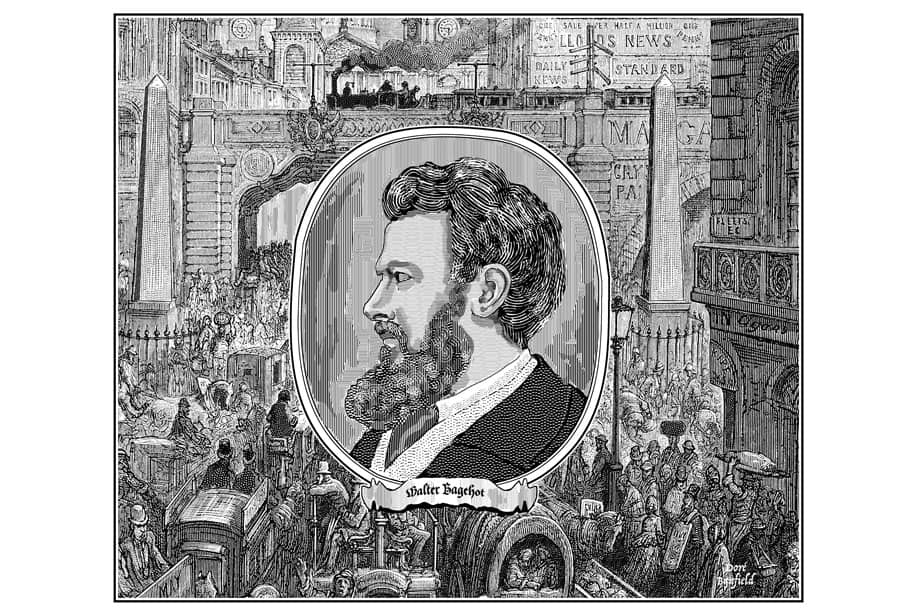

In the spring of 2008, at the depths of the Great Recession, when the chairman of the Federal Reserve Bank, Ben Bernanke, spoke to the Federal Reserve Bank of Atlanta’s Financial Markets Conference, he invoked as his charm for warding off fiscal doom a man whose name most of his hearers had never encountered and a book which was 135 years old. “Walter Bagehot’s Lombard Street, published in 1873,” Bernanke announced, “remains one of the classic treatments of the role of the central bank in the management of financial crises.” That role, he explained, required the Fed to come galloping to the bailout of banks that were too big to fail. “[T]he basic logic in Bagehot’s prescription for crisis management” was that “[a] central bank may be able to eliminate, or at least attenuate, adverse outcomes by making cash loans secured by borrowers’ illiquid but sound assets.”

Bernanke had been reading Bagehot since his days as a Princeton University economics professor, and it was from Bagehot that he embraced the idea that a central bank should be “the lender of last resort” who keeps troubled financial institutions afloat. It was with Bagehot in mind that Bernanke and the Fed moved to save Bear Stearns and smooth its absorption by JPMorgan, and then produced a $180 billion lifeboat for American International Group when it sagged disastrously toward insolvency. Bagehot’s “prescription” had become Bernanke’s dictum.

* * *

Yet nothing would have surprised Walter Bagehot more than the attachment of his name to a financial strategy which, in fact, violated the principal tenets of his classic book on English banking. And to show how far this strategy has strayed from the man himself is one theme of James Grant’s new biography, Bagehot: The Life and Times of the Greatest Victorian.

The founder of the bimonthly Grant’s Interest Rate Observer, James Grant is better known on the high plains of investment and finance, where he enjoys a status only slightly lower than that of a classical deity. Actually, his first love was music—playing the French horn—but after a stint in the Navy, Grant turned instead to economics at Indiana University and international relations at Columbia. At the latter, he strayed happily into the ken of polymath Jacques Barzun, who drew Grant to the West’s cultural and intellectual history. He began writing financial journalism for the Baltimore Sun in 1972, graduated to Barron’s in 1975, and started Grant’s Interest Rate Observer in 1983. Though Grant clearly had a talent for numbers, Barzun had triggered a passion for words, and so at the same time he wrote commentary on markets he penned winning biographies of financier Bernard Baruch (1983), President John Adams (2005), and Speaker of the House Thomas B. Reed (2011).

Grant knew enough about Bagehot to suspect that Bernanke was appealing to only half a dictum about central banks serving as lenders of last resort. Bagehot’s actual dictum was, as Grant wrote in an opinion piece for the New York Sun at the time of the bailouts, “that, in a credit crisis, a central bank should lend freely against good collateral at a high rate of interest.” Bernanke ignored Bagehot’s enduring loyalty to a gold-standard currency. Even more flagrantly, he ignored Bagehot’s specification that central-bank rescues only take place when there is “good collateral” on offer by the rescued—“short-dated, self-liquidating IOUs,” and definitely not mortgages, which were “inherently illiquid”—and when “a high rate of interest” is charged, to keep more bad lending from taking place. Bernanke’s bailouts included none of those caveats.

Back in 2008, Grant’s sympathies ran more readily in the direction of Bagehot’s rival, Thomson Hankey, who vainly warned the Bank of England that Bagehot’s advice would encourage “every banker, trader, merchant, and speculator” to throw caution to the winds, over-reach, over-borrow, and overextend. “A brilliant man was Walter Bagehot,” Grant concluded in the Sun, “but Hankey had the foresight.”

Ten years later, Grant still sides with Hankey, but he has gained more than the usual appreciation of Bagehot as “a brilliant man.” It may be stretching things to award him the title of “greatest Victorian”—it was, after all, the age of Charles Dickens, Benjamin Disraeli, Florence Nightingale, Anthony Trollope, George Eliot, William Gladstone, Alfred Lord Tennyson, and John Stuart Mill, any one of whom may have a better claim to “greatest” than Bagehot. But not by much.

Bagehot (the name was pronounced somewhere between badge-it and badge-oat, depending on whose accent governed the pronouncing) was born in 1826 in Langport, in the west country of England that Thomas Hardy—another candidate for “greatest Victorian”—would immortalize in his novels as “Wessex.” His birth came on the cusp of a serious bank panic. The Napoleonic Wars had forced the Bank of England to suspend the exchange of gold from its reserves for paper bank notes (some £12 million in the Bank’s own notes and another £12 million from Britain’s circle of more than 200 private banks) so that for two decades the British economy functioned loosely on paper money. But in 1821, gold exchange was restored by Parliament, the Bank relaxed its borrowing requirements, and new investment opportunities in South America and, closer to home, in the new-fangled railroads sent the economy to new heights. Until, of course, in 1826 the South American republics defaulted on their loans and the railroads failed, and panic ensued.

* * *

“The evil will cure itself,” announced the prime minister, Lord Liverpool, provided that the paper currency remains “convertible into coin.” And it did, barely. One of the private banks that survived was Bagehot’s father’s employer, S & G Stuckey & Co. Walter’s mother was a Stuckey, and it took no genius to guess that Walter would be pointed toward some kind of financial career. But he was a precocious and gifted child, reading the Aeneid (in Latin) by the time he was 13 and Newton’s Principia by 15. Bagehot’s father was a Unitarian, so there was no point in applying to Anglican Oxford. Walter instead found an alternative in 1842 in University College, London, which had been founded in the year of Walter’s birth precisely to outflank Oxford.

In the precincts of “godless Gower Street,” Bagehot found himself awash in a colorful lake of Protestant dissenters, Unitarians, and agnostics. His friend Richard Holt Hutton remembered University College as “a much more awakening place of education for young men than almost any Oxford college.” After graduation, Bagehot tried, without enthusiasm, to press himself into studying law in Lincoln’s Inn—a society for English barristers—and turned his hand, with greater success, to journalism. He eventually gave up on law, and finally returned to Langport to join Stuckey’s Bank. But, as Grant concedes, “[l]iterature was the love of Bagehot’s life,” and he soon achieved a niche in the fat literary reviews of the day with essays on Shakespeare, Milton, Gibbon, Cowper, and Shelley. But he also began writing on economic issues, and in 1861 he succeeded his friend Hutton as editor of the Economist. Letters and numbers had met at last.

* * *

Bagehot believed, as grant is eager to establish, that money is simply “the measure of capital”—in other words, it puts a convenient, measurable number value on the products of “invention and enterprise.” The most stable form of money was “gold and silver and that alone.” Everything else, even the notes of the Bank of England, were simply tokens useful for easy exchange as payment for goods and services, in “which it followed that the government had no business intervening,” Grant explains. The problem was that “invention and enterprise,” among other things, are dynamic, and constantly unbalance the stability of money by urging the extension of credit and investment, in the form of loans and stock. These new enterprises might generate newer, more massive kinds of wealth; or, they just might end in smoke and wind.

The most dramatic demonstration of that unpredictability in Bagehot’s time occurred in the 1860s, with the advent of the new French-style crédit mobilier financial firms, which had no depositors but instead traded purely in securities. One English imitator of these firms, with the ominous name of Overend, Gurney & Co., hugely over-extended itself, and on May 10, 1866, after a failed appeal for rescue to the Bank of England, it collapsed. Thomson Hankey, a former governor and deputy governor of the Bank of England, defended the Bank’s inaction: “[T]he trading community must be taught at some time or other that no such establishment as the Bank of England can…com[e] to the rescue whenever any financial difficulty may arise.” Otherwise, the Bank ran the “moral Hazard” of encouraging a spirit of recklessness and irresponsibility throughout the economy.

Bagehot disagreed. The failure of Overend Gurney caused a national crisis: “a complete collapse of credit in Lombard Street and a greater amount of anxiety than I have ever seen.” How could the Bank of England stand aloof? Its position as the empire’s central bank obliged it to “support the banking community” and “make the reserve of the Bank of England do for them as well as for itself.” Hence, “The Bank of England agrees to give other banks the requisite assistance in case of need, and the other banks agree to ask for it.”

* * *

Yet Bagehot was certainly no respecter of junk investments. He warned in Lombard Street that speculation in the London money markets had come unhinged, and he opposed Prime Minister Benjamin Disraeli’s purchase in 1875 of a controlling interest in the Suez Canal out of fear it would entangle Britain in an endless skein of political knots in the Middle East (which it did). Bagehot was, as Grant repeatedly reminds us, an exercise in paradox. He was a close adviser to William Gladstone and counted himself politically among the Liberals; yet he had a snobbish condescension toward “the English poor,” whom he found “clearly wanting in the nicer part of those feelings which, taken together, we call the sense of morality.” A brilliant conversationalist and a great and ready writer who composed “fast and fluently—and with a steel pen,” he was (unlike James Grant) so ineffectual a public speaker that when he stood for Parliament for Manchester in 1865, audiences “started to laugh, not with Bagehot but at him.” He was catastrophically wrong in predicting a Confederate victory in the Civil War; yet he wrote, penitentially, one of the most moving eulogies of Abraham Lincoln to appear in the British press.

John Maynard Keynes once dismissed Bagehot as “a psychologist…not of the great or of genius, but of those of a middle position, and primarily of business men, financiers, and politicians.” Grant’s ironic, witty, vividly well-written biography will do much to redeem Bagehot from that brush-off. And it may show that Bernanke needed to have taken more of Bagehot—especially on money—more seriously.