Books Reviewed

History forgets bankers, as a rule. “From Who’s Who to Who’s that?” quipped Walter Wriston concerning his vanishing reputation as the retired chairman of what is today Citigroup. In the case of Ben S. Bernanke, chairman of the Federal Reserve from 2006 to 2014, history may make an exception. If so, history will show her generosity of spirit, for the author of this narrative has little use for the past. Revolutionary action was rather the theme of the Bernanke stewardship—there being no other choice, as the former chairman insists here. The Courage to Act is his self-exculpating memoir.

Act, he did. On his watch, the federal authorities dropped short-term interest rates to zero, materialized trillions of dollars out of thin air, bailed out certain giant financial institutions (while letting others founder), boosted federal guarantees of bank deposits, issued a blanket federal guarantee of money-market mutual fund balances, and became the hovering regulatory overseer of vast segments of American finance. It’s Bernanke’s contention—nothing new about it in these pages—that he did only what he had to do to fend off some worse-than-Great Depression. He does not rest his case only on events, which were certainly scary enough. His case ultimately depends on what would have happened in the absence of radical action. Like his critics, he can only suppose.

* * *

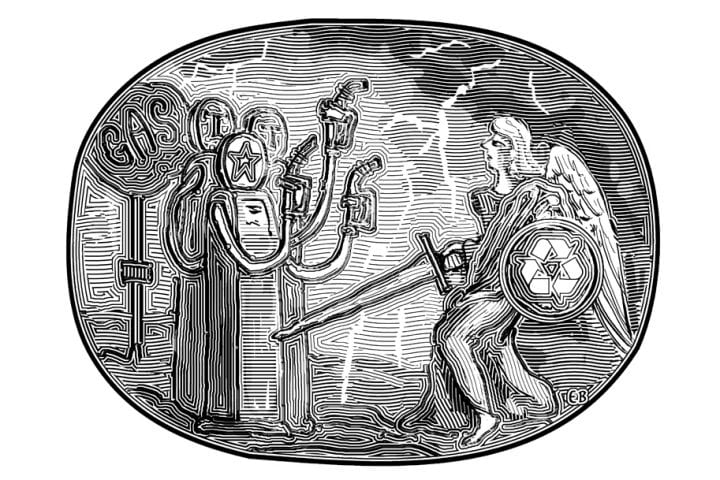

In a touch of becoming modesty, the author describes himself not as a scholar of the Great Depression (which he is not, popular perception to the contrary) but as a “buff.” He rather draws his conclusions about the events of 1929-33 from Milton Friedman and Anna Schwartz, co-authors of A Monetary History of the United States: 1867–1960 (1963), which contends that the Federal Reserve did too little and that too late. The pros and cons of Friedman and Schwartz’s interpretation have been grist for many a book. I will only add here that Anna Schwartz, when asked about the Fed’s unprecedented response to the difficulties of 2007-09, dryly remarked that Bernanke seemed to know only two figures, trillion and zero. To this day, few have taken the full measure of these extraordinary actions. In place of what Adam Smith called the invisible hand (and Friedrich Hayek the price mechanism) Bernanke et al. imposed mandarin rule. It is with us today.

History, for whom I now presume to speak, will see that these efforts, radical though they are, had long been in the works. Thus, in 1971, the Nixon Administration replaced the gold dollar (that is, a dollar that foreign governments might exchange, at their pleasure, for gold at the rate of $35 an ounce) with the pure paper dollar. Liberated from the discipline of gold convertibility, Congress was freed to spend and the Fed to improvise. Thirteen years after this monetary démarche, in 1984, the Continental Illinois Bank came near to failing. Riding to its rescue, the Reagan Administration declared that some banks are too big to fail. In so doing the Republicans established a precedent that made the de facto socialization of credit during the Great Recession seem a little less shocking than it otherwise might have appeared.

There was a third formative episode in the federalization of American finance. In 1998—to be exact, on October 15, 1998, shortly after 3 p.m.—Alan Greenspan’s Fed implemented a surprise reduction in the key federal funds rate, to 5% from 5¼%. There was nothing wrong with the economy. The trouble that led the Fed to pull this rabbit out of a hat (as journalist Martin Mayer put it) was the crisis surrounding Russian debt and the wobbly Long Term Capital Management hedge fund. In response to the downward adjustment in the funds rate, the stock market leapt by 7% over the next 25 hours. Greenspan’s intervention was a formative teaching moment. It taught that the government was on the side of the bulls.

* * *

Many years before the coming either of the Fed or of federal deposit insurance, George Williams, the eminent head of Chemical Bank of New York, had credited his success to “the fear of God.” Under the dual regime of an unfettered central bank and the quasi-socialization of risk, the new way forward is “trust in the government.” Bernanke’s strong suit is not self-awareness. The man who tried to save finance by socializing it professes to hold “the standard economist’s preference for relying on market forces where possible.” Whether posterity approves or disapproves of his actions, it is unlikely to follow his reasoning.

A personal prelude introduces Bernanke’s financial narrative-cum-apologia. The autobiographical fragment begins with his boyhood in Dillon, South Carolina. His father runs a drugstore; his mother stays at home. Their precocious son wins the state spelling championship, achieves the state’s highest SAT scores, and gains admission to Harvard. He distinguishes himself there and in graduate studies at MIT. A freshly-minted Ph.D. in economics, he joins the faculty of the Stanford Graduate School of Business where he finds he is “good at explaining things.”

He still is. His descriptions of monetary economics and corporate finance are clear and accessible, whether or not you agree with him. He gives you plenty of dates so you can track the course of these ghastly events. His workmanlike prose is nothing like the writing that fills the academic economics journals (I mean this in a friendly way).

Presently, the economist—by now a Princeton professor—joins the Federal Reserve Board, which he uses as a bully pulpit. In speeches to public audiences, he asserts that too little inflation is just as harmful as too much. He vows that the Federal Reserve will never again preside over a general collapse in prices and business activity but will rather create enough dollar bills to beat back any deflationary tide. In arguing the latter proposition, Bernanke invokes the imagery of a central bank dropping currency out of helicopter doors. His advisors warn him against this inflammatory metaphor, which Milton Friedman coined. Ignoring them, Bernanke earns the sobriquet “Helicopter Ben.”

* * *

After a stint as head of the Council of Economic Advisors under George W. Bush (the president ribs him about his pairing of tan socks and a dark suit), Bernanke is installed as chairman of the Federal Reserve Board in early 2006. Up on his bookshelves goes Lombard Street, Walter Bagehot’s famous survey of London high finance in the mid-19th century. In it, Bagehot charges the Bank of England with responsibility, in a panic, for lending freely at high interest rates to solvent banks against good collateral. Bernanke imbibes, especially, the part of the message having to do with lending freely.

The crisis of 2007-09 takes him unawares—it surprises nearly everyone at the Federal Reserve. For all the software and brainpower on the premises, the central bankers have missed the greatest financial upheaval of their professional lives—Bernanke here vaingloriously asserts the greatest in the history of the world. A more introspective memoirist than the author might pause to speculate on the meaning of this oversight. One measure of the efficacy of science is its power of prediction. The world would think less of the meteorologists if they failed to forecast the all-time biggest blizzard. Bernanke seems to think no less of economists because they botched the biggest financial storm. If he entertains doubts about the scientific pretensions of his lifelong field of study, he keeps them to himself.

The author describes the premonitory rumbles of 2007: write-downs in the value of subprime mortgages, troubles in the market for auction-rate securities, difficulties in off-balance-sheet investment vehicles, the mounting losses at Bear Stearns. He seems uncurious about the clustering of these troubles. Clearly, he is not listening to Douglas Lucas, an executive director of the Swiss bank UBS, who as early as August 2007 refers to the gathering storm as “the greatest ratings and credit risk-management failure ever.”

Comes next the annus horribilis, 2008. The so-called government-sponsored enterprises Fannie Mae and Freddie Mac are put into conservatorship. Citigroup becomes a ward of the state. Merrill Lynch is absorbed by Bank of America, Wachovia by Wells Fargo, before each can fail. Bernanke devotes 90 pages, 15% of the narrative, to the seemingly endless month of September, during which Lehman Brothers goes broke and AIG is seized by the government (those blows fall in a single week). By the time bedraggled financiers can toast the arrival of 2009, the domino theory of the Vietnam years has played out in American finance.

* * *

Washington spawns new agencies to infuse funds and allay panic—interventions feed on each other just as failures do. Acronyms crowd these pages: CPFF (Commercial Paper Funding Facility), PDCF (Primary Dealer Credit Facility), TAF (Term Auction Facility), TALF (Term Asset-Backed Securities Loan Facility), TARP (Troubled Asset Relief Program), TLGP (Temporary Liquidity Guarantee Program). Bernanke, in company with Secretary of the Treasury Hank Paulson, summons the chieftains of nine major financial institutions to Washington to thrust federal capital at them. Only one, on Bernanke’s telling—“Dick Kovacevich of Wells Fargo, feisty as always”—protests before acceding.

Not even these mighty efforts turn the confidence trick. To push down long-term interest rates, the Fed embarks on “quantitative easing,” or Q.E. It will buy more than $3 trillion of bonds and mortgages with funds that didn’t exist until the central bank materialized them. The stock market, too, is harnessed in the cause of recovery. For the first time of which I am aware, a Fed chairman—the author himself—cheers on the Dow. “[H]igher stock prices will boost consumer wealth and help increase confidence, which can also spur spending,” he writes in the Washington Post. “A new era of monetary policy activism had arrived,” he observes in this memoir in a chapter appropriately headed, “Quantitative Easing: The End of Orthodoxy.”

* * *

Bernanke declines to engage in any substantive way with the opponents of heterodoxy. When the head of the FDIC (Federal Deposit Insurance Corporation), Sheila Bair, resists his plea to issue a wholesale guarantee of the debts of the entire banking system (not just its insured deposits), he complains that she “became pricklier as events pushed her into taking steps further out of her comfort zone.” He lumps his in-house critics together under the undifferentiated moniker, “hawks.” He writes as if opinions were settled science. For instance, in the absence of a 2% rate of inflation, one risks “deflation.” Also: The gold standard is a “discredited” monetary system; the cause of the Great Depression was overly stringent Federal Reserve policy; laissez-faire doesn’t work in a crisis.

Many revere Bernanke as the hero who saved the American financial system by almost nationalizing it. Bernanke himself is one of this number. “[T]hese programs,” he writes of the acronymic collection of interventions cited above, “prevented the financial system from seizing up and helped to keep credit flowing. Walter Bagehot would have been pleased.”

Bagehot, whom Bernanke cites more frequently in these pages than nearly any living economist, accepted the gold standard as the enlightened monetary regime of his age; prices and wages could adjust as needed but the value of money, defined as a weight of gold, would remain the same. Though he urged the Bank of England to acknowledge its duty as a lender of last resort, Bagehot was no less adamant that investors must bear the losses for which they were responsible. What this meant during the first years of Bagehot’s career is that the stockholders of a British bank were personally responsible for the debts of the firm in which they owned a fractional interest. Their wealth was at risk down to “the last shilling and the last acre,” as the expression went. By the 1860s, sentiment had begun to swing toward some form of limited liability. Still, Bagehot supported the principle that the shareholders of every bank should be subject to a capital call if the institution in which they had invested became impaired or insolvent.

Would Bagehot have been pleased by the virtual nationalization of American finance in the wake of a crisis that was partly instigated by financiers who had been taught to expect that the state would help them whenever the going got rough? I expect that Bagehot would have been appalled.