Books Reviewed

A review of Nudge: Improving Decisions About Health, Wealth, and Happiness , by Richard Thaler and Cass R. Sunstein

, by Richard Thaler and Cass R. Sunstein

The economy, and economics, are in crisis. A severe recession is upon us, and the Obama Administration, although stuffed full of leading economists, has only the vaguest idea of how to fix it. The bursting of the housing bubble cast in doubt the reigning orthodoxy that financial markets can govern Wall Street. The institutions that fund housing over-extended themselves, granting mortgages to many home buyers who could not afford them. Banks woke up last fall to realize that many of the loans they held were worthless. Some banks failed; others were bailed out by the government. Further lending dried up, and growth reversed. The vast stimulus bill passed by Congress in February is a desperate attempt to restart the economy with a flood of cash. No one is at all sure it will work because panic reigns, an emotion that lies entirely outside conventional economics.

In economic theory, the markets should have refused credit to the insolvent or charged them higher interest to cover the risks of default. But this assumes greater powers to calculate risk than buyers and sellers had. Mortgages today are packaged as securities that have become too complex for analysts to appraise. So everyone went on selling, confident that the prices were real. Suddenly it became plain that they were not. On a Wall Street stocked with MBAs, how could this happen?

Economics has traditionally ignored psychology. In Nudge, Richard Thaler and Cass Sunstein take a step toward greater realism about it. Thaler teaches economics at the University of Chicago and was an unofficial advisor to the Obama campaign. Sunstein is a law professor at Harvard and now the head of the Office of Information and Regulatory Affairs in the Obama Administration. The authors start off by differentiating "Econs" from "Humans." The former are the efficient calculators imagined in economic theory, able to weigh multiple options, forecast all the consequences of each, and choose rationally. The latter are ordinary people, who, like the analysts on Wall Street, fall well short of homo economicus. Humans operate by rules of thumb that often lead them astray. They are too prone to generalize, biased in favor of the status quo, more concerned to avoid loss than make gains, among other shortcomings. So they often fail to manage their personal affairs to the best advantage.

Thaler and Sunstein think that ordinary folk should be "nudged" to decide more rationally. A "nudge," as they conceive it, means some change in the "choice architecture" surrounding personal decisions that will cause Humans to choose differently and better, even though an Econ would be unswayed. Often that means changing the default option—the choice made for people if they do not choose. For example, many employees save too little for their retirement because they fail to sign up for 401(k) plans offered by their employers. The authors would change the default from opt-out to opt-in-employees would be enrolled in pension plans unless they said otherwise. Workers would also be encouraged to commit now to pay higher pension contributions in future, if not today. Both steps would raise savings substantially. Another nudge would be to establish better defaults for allocating pension contributions among different investments. Also, many people say they are willing to donate their organs for transplants when they die, yet fail to sign up. Again, the authors would change the default from opt-out to opt-in-people would be presumed willing to donate unless they declined.

The authors say that for Econs, the more choices the better, but Humans should not face too many options, lest they be overwhelmed. Sweden erred in reforming its pension system so that people had to choose among myriad retirement plans on their own, something many did poorly. The authors criticize Medicare for forcing seniors to choose among multiple private plans to get prescription drug coverage. Subscribers should face only a few options based on their prior drug history.

The usual objections to such paternalism are that it is coercive and that those making choices for people can't be trusted. Thaler and Sunstein say that their paternalism is "libertarian": their nudges would allow people to deviate from recommended choices without significant cost. The authors also trust that nudging could and would be publicly justified, not secretive.

* * *

Nudge draws on behavioral economics, a branch of economics that studies the limits of rationality. Daniel Kahneman and Amos Tversky first developed the field in the 1970s and '80s, and Thaler was one of their collaborators. But although Kahneman won the Nobel Prize in 2002, behavioralism is still a marginal field in economics. That is because looking too closely at people's actual psychology would constrain the ambitions of the dismal science too much.

Mostly, economists imagine how people would behave in some situation if they were Econs. Individuals, they believe, will act so as to maximize their utility, usually meaning material rewards in some form. That is, they will respond to incentives. Whether they consciously do so or not is ignored. Most economists long ago accepted Milton Friedman's argument that economic theory need not be realistic, only predictive. For mainstream economics, it is enough that people act as if they economized, whatever their actual psychology. It is enough that they do so in the aggregate and long-term, if not in every case. The predictions are then tested against actual behavior using data usually gathered by others. Economists construct elaborate statistical models to show that the incentives tested do sway actions in the expected direction, controlling for other factors.

Economists have boldly extended this approach to behavior well beyond the economy—everything from marriage to international relations. The beauty of "rational choice" is that it can "explain" virtually anything, without close inquiry into people's actual attitudes or other grubby details. Provided only that data is available, expected outcomes can be posited and confirmed entirely from behind one's computer. One can turn out articles at high speed, which serves academic incentives to publish and not perish. The appeal of these methods is considerable. Rational choice has expanded beyond economics to take over much of sociology and political science, provoking intense resistance from scholars wedded to more eclectic or less mathematical methods.

What economists mainly study in graduate school is not the economy but the mathematical methods required to frame and confirm rational choice hypotheses. They then apply this "tool kit" promiscuously to all manner of questions. Pride in their quantitative skills makes leading economists among the most cocksure figures in academia. In Freakonomics (2005), for instance, Steven D. Levitt and Stephen J. Dubner showed how economic methods can explain numerous puzzles in social behavior. The results are intriquing but also superficial.

For example, Levitt and Dubner show why teachers in public schools have incentives to help their students cheat on achievement tests—to make themselves look better. But they cannot explain why the teachers would violate their professional ethics to do this. Similarly, they show why low-level drug dealers have an incentive to work for low wages—to become drug bosses and make much more. But they cannot explain the climate of failure that causes poor youth to go into the drug trade in the first place. To explain behavior more fully would require the authors to undertake a deeper, more humble inquiry, involving more information sources and more hands-on contact with the phenomena under study. That sort of labor generates few academic plaudits today, and most economists avoid it.

Thaler and Sunstein are not immune to cocksure pronouncements themselves. Although they advise us to expect less from popular rationality, they recommend expanding choice in schooling and in credit markets, mainly by forcing plainer disclosure of what each option might mean. They would allow patients to give up the right to sue doctors for malpractice in return for lower fees. They would even privatize marriage, taking government out of the business of policing intimate relationships. These ideas are less well supported than the "nudges." They appeal precisely to the Econ personality that the authors otherwise question. In these chapters we still sense the facile pretensions of economics to be a universal science.

* * *

The authors dig more deeply into reality than most economists, yet their empiricism is still limited. They find the public lacking in rationality, but they never discuss the more serious dysfunctions of the underclass. Perhaps the middle class under-saves, but the poor often fail to work at all, generate female-headed families, and succumb to drug addiction or crime. To counter those patterns, social policy has lately become far more paternalist than anything Thaler and Sunstein have in mind. Welfare recipients must work to get aid, the homeless must obey rules to get shelter, and students must pass tests to be promoted in school. Those demands are not libertarian. They are presented as obligations, not choices.

Even among the mainstream population, behavioralism covers only a small part of economic behavior. Its findings come largely from closely controlled experiments in which only certain variables are manipulated. The results hardly apply to a crisis like the present, in which the whole economic system seems in question. To understand what is happening and how to change it requires a broader, less rigorous grasp of the economy than today's mathematical economics can provide. Insight is more likely to come from public figures who are only notionally economists but have long experience of government with its many inputs—such as former Federal Reserve chairmen Paul Volcker and Alan Greenspan. The current chairman, Ben Bernanke, is an academic economist who has seemed out of his depth, although he is learning fast.

The market's "invisible hand" forces buyers and sellers to serve others as they serve themselves, but it must be undergirded by rules of legality and fair play that do not always serve individual self-interest. Morals, not just calculation, have broken down in today's crisis. Borrowers and lenders no longer trust each other enough to do business. To establish or restore trust requires civic virtue, something which today's economics, based as it is on egoistic calculation, cannot explain or produce.

Today's economists are unlikely to perceive, let alone solve, a moral crisis because, as Nudge admits, they are "pretty unsociable creatures." They seek mainly their own advantage, and they expect others to do the same. The authors discuss Humans' tendency to care about the views of others only as a violation of rationality, not a virtue. Yet without it, who would make deals with strangers? A lack of trust and civility is one reason markets fail to make societies rich in the less developed world. The ethos of modern economics is at war with the moral basis of capitalism.

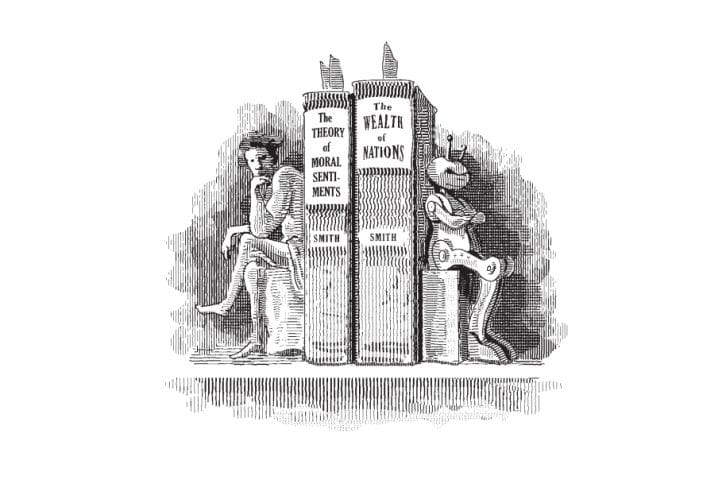

It was not always thus. The father of economics treated human nature as the foundation of the marketplace. Adam Smith produced an entire treatise on popular psychology—The Theory of Moral Sentiments—before he ventured to write The Wealth of Nations, with its paeans to economic freedom. People may appear selfish, he argued, but in fact they sympathize with the pains and pleasures of others. That virtue is essential to a successful society. Thaler and Sunstein observe it in Humans, and they display it themselves by seeking to nudge others toward rationality. Today's economics, however, marginalizes such thoughts, and can offer little guidance in our current predicament.